Common Mistakes in Crypto Investing: Cryptocurrency investing can be both thrilling and scary. Millions of investors worldwide are drawn in by the prospect of large returns and quick market expansion, but the same volatility that generates opportunity also carries a high risk. Many novices go in without fully comprehending the intricacies of the market, succumbing to emotional decision-making, hype, or inadequate security procedures.

Crypto requires prudence, discipline, and understanding, unlike traditional investing. Long-term success depends on identifying typical errors, such as ignoring risk management or research. This article examines the most common mistakes made by cryptocurrency investors and provides helpful advice to help you steer clear of them.

Common Mistakes in Crypto Investing.

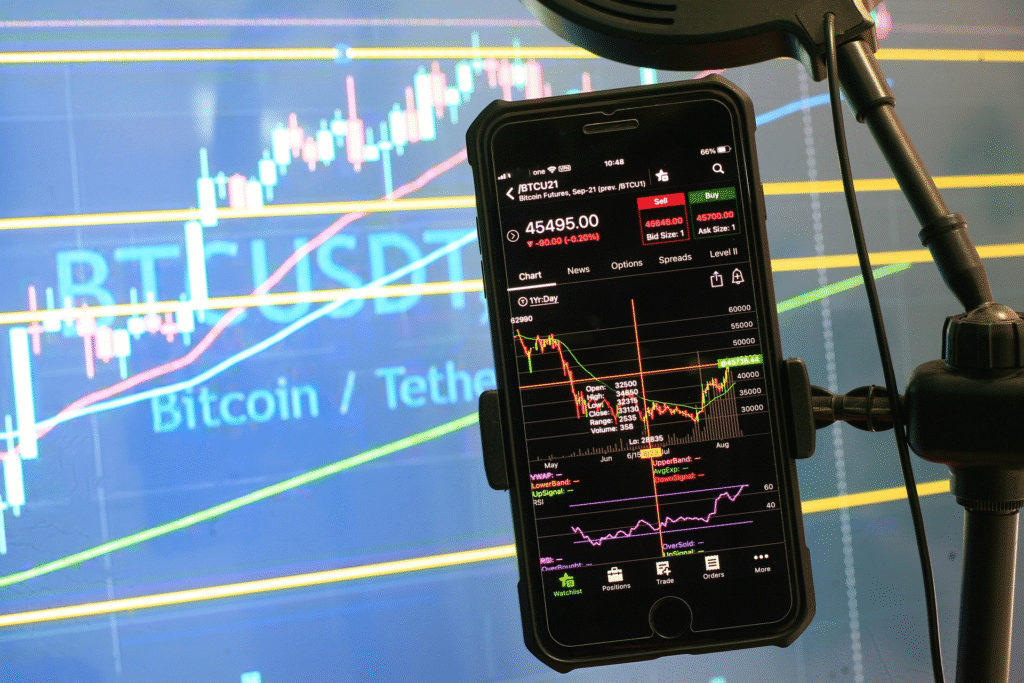

Investing in cryptocurrencies has drawn the interest of millions of people worldwide. It is simple to understand why cryptocurrency appeals to both experienced traders and novice investors, given the anecdotes of early Bitcoin investors who turned little sums into fortunes and the weekly introduction of new digital coins. But the cryptocurrency market is erratic, unpredictable, and full of dangers that may quickly ensnare the unprepared.

Although there is a chance for profit, there is also a chance of loss, frequently as a result of preventable errors. You can traverse the cryptocurrency market more effectively and safely if you are aware of the typical mistakes made by investors.

Here, we look at some of the most typical cryptocurrency investing blunders, their causes, and ways to steer clear of them.

(1) Investing Without Research.

Common Mistakes in Crypto Investing: The most common error made by novice cryptocurrency investors is probably entering the market without doing enough research. Without knowing what the project does or how it operates, a lot of people purchase coins merely because they heard about them via friends or on social media.

Each cryptocurrency has a whitepaper, which is a document that describes its goals, technology, and future plans. Ignoring this information would be equivalent to making an investment in a business without first reviewing its financial reports.

Why it’s risky:

Investors can easily become victims of hype-driven or fraudulent tokens if they do not comprehend the basics of a project, including its use case, development team, community support, and tokenomics.

How to avoid it:

Examine a cryptocurrency’s goal, the issue it seeks to address, its market potential, and the team’s reputation before making an investment. Instead of depending on internet rumors or suggestions from influencers, follow reliable sources.

(2) Falling for Hype and Fear of Missing Out (FOMO).

Common Mistakes in Crypto Investing: Hype cycles are a common occurrence in cryptocurrency markets. In a week, the price of a coin may increase by 300%, igniting a social media frenzy and generating a sense of urgency: “Buy now or miss out forever!”

FOMO (Fear of Missing Out) is the term for this emotional response, which frequently causes investors to purchase at the height of a price rally only to witness the value plummet shortly thereafter.

Why it’s risky:

Buying based on hype rather than analysis often results in losses, as prices frequently correct after sharp upward movements.

How to avoid it:

Adhere to a well-defined investing plan. Avoid letting your feelings guide your choices. Remember that the cryptocurrency market is cyclical, so even if you missed a certain rise, there will always be fresh possibilities.

(3) Ignoring Risk Management.

An effective investing strategy must include risk management, yet many cryptocurrency investors fail to do so. They might employ excessive leverage on trading platforms or put all of their savings into a single coin.

Why it’s risky:

The cryptocurrency market is extremely erratic; in a single day, values might fluctuate by 20% or more. An entire portfolio might be destroyed by a rapid downturn if risk management is not done properly.

How to avoid it:

- Never invest more than you can afford to lose.

- Diversify your portfolio across multiple assets.

- Set stop-loss orders to limit potential losses.

- Keep a portion of your portfolio in stablecoins or less volatile assets.

By managing risk properly, you can survive market downturns and stay invested long enough to benefit from long-term growth.

(4) Using Unsecured or Unregulated Exchanges.

Common Mistakes in Crypto Investing: A lot of people select cryptocurrency exchanges without taking their security or reputation into account. The majority of exchanges are genuine; however, some have been compromised, gone bankrupt, or disappeared overnight with user money.

Why it’s risky:

Users frequently have no means to get their money back if an exchange is hacked or goes offline. Since cryptocurrency transactions cannot be reversed, if money is lost, it cannot be recovered.

How to avoid it:

- Use exchanges that are regulated, have strong security records, and support two-factor authentication (2FA).

- Avoid keeping large amounts of crypto on an exchange.

- Use cold wallets (hardware wallets) for long-term storage, as they are not connected to the internet and are much harder to hack.

(5) Neglecting Security Practices.

One of the most important factors in cryptocurrency investing is cybersecurity. Numerous investors have lost money as a result of malware, phishing scams, or just misplacing their private keys.

Why it’s risky:

Unlike banks, crypto holdings are self-custodied. If your wallet is hacked or you lose your seed phrase, there’s no customer service to help you recover your funds.

How to avoid it:

- Always enable 2FA on your exchange accounts.

- Never share your private keys or seed phrases with anyone.

- Avoid clicking on suspicious links or downloading unknown files.

- Use hardware wallets for added security.

- Back up your seed phrases in a secure, offline location.

Remember: “Not your keys, not your coins.”

(6) Overtrading and chasing short-term gains.

Many novice investors make the mistake of buying and selling all the time in an attempt to profit from every change in price. Because of trading commissions, this strategy can easily become draining, unpleasant, and expensive.

Why it’s risky:

Due to the extreme volatility of cryptocurrency markets, short-term trading frequently results in rash decisions. If you are trading based more on instinct than on a plan, overtrading can result in losses that accumulate over time.

How to avoid it:

If you want to accumulate wealth instead of speculating on daily price fluctuations, adopt a long-term perspective. Dollar-cost averaging (DCA), which involves consistently investing a certain amount regardless of market conditions, is one strategy used by many successful investors.

(7) Ignoring Tax Obligations.

Most nations impose taxes on cryptocurrency income, but many investors choose not to disclose it or just forget to do so. There may be severe legal repercussions for this.

Why it’s risky:

Tax authorities around the world are improving their ability to track crypto transactions. Failing to report income or capital gains can result in fines, audits, or even criminal charges.

How to avoid it:

- Keep detailed records of all your transactions.

- Consult a tax professional who understands cryptocurrency regulations in your country.

(8) Falling for Scams and Rug Pulls.

Regrettably, scams are widespread in the cryptocurrency industry. Numerous people have lost money to fraudulent ventures, ranging from phony initial coin offerings (ICOs) to “rug pulls,” in which creators disappear after receiving investor payments.

Why it’s risky:

Scammers exploit the lack of regulation and the anonymity of blockchain technology. Once your crypto is sent to a scammer, recovery is nearly impossible.

How to avoid it:

- Be skeptical of “too-good-to-be-true” promises.

- Avoid projects without transparent teams or verifiable audits.

- Check online communities and forums for red flags.

- Stick with well-known, established projects.

(9) Ignoring Market Cycles.

Markets for cryptocurrencies move in cycles, usually alternating between periods of growing and waning bullishness. Many investors buy at peaks or sell during panics because they are unable to identify these trends.

Why it’s risky:

The antithesis of what successful investors do is to buy high and sell low. Your portfolio may suffer long-term harm from emotional responses to transient swings.

How to avoid it:

Recognize that corrections are a normal feature of the market by studying previous market cycles. Maintaining a long-term outlook keeps you composed during downturns and self-assured during recoveries.

(10) Lack of a Clear Strategy.

Last but not least, a lot of investors enter the cryptocurrency market without a clear strategy; they make rash purchases, hold wildly, and sell in a panic. It is impossible to gauge success without well-defined objectives.

Why it’s risky:

Without a plan, your decisions are driven by emotion, not logic. This often leads to inconsistent results and frustration.

How to avoid it:

Develop a strategy that defines:

- Your investment goals (short-term trading, long-term holding, passive income, etc.)

- Your entry and exit criteria

- Your risk tolerance and allocation strategy

- How you will respond to market fluctuations

A disciplined approach builds consistency and reduces emotional stress.

Conclusion.

Although investing in cryptocurrencies presents intriguing potential, it is not a surefire way to become wealthy. The market penalizes people who behave impulsively or ignorantly and rewards those who are well-informed, disciplined, and cautious.

You can strengthen your foundation for long-term success in the bitcoin market by avoiding the typical blunders listed above, such as investing without doing your homework, following hype, ignoring security, or ignoring risk management.

Keep in mind that your biggest partners in cryptocurrency (like in other investments) are discipline, patience, and information. Never invest more than you can afford to lose, think long-term, and concentrate on lifelong learning. You will be considerably more protected by that mindset than by any “get rich quick” plan.