Achieving Bitcoin Trading Mastery: Learn Winning Strategies Now is the goal of every cryptocurrency trader who wants to transform their financial future. The journey to mastering Bitcoin trading requires more than just understanding price charts—it demands a comprehensive approach combining technical analysis, risk management, and psychological discipline. With Bitcoin surging above $110,000 in 2025 and institutional adoption reaching new heights, the opportunities for profitable trading have never been greater.

The path to Bitcoin trading mastery starts with understanding that successful trading is not about winning every single trade, but rather about developing a systematic approach that generates consistent profits over time. Professional traders who have achieved mastery combine multiple strategies, adapt to changing market conditions, and maintain strict risk management protocols that protect their capital during inevitable losing streaks.

This comprehensive guide reveals the winning strategies that professional Bitcoin traders use to generate substantial returns. Whether you’re a beginner looking to make your first profitable trade or an experienced trader seeking to refine your approach, these proven techniques will accelerate your journey toward trading mastery and financial independence.

Understanding the Path to Bitcoin Trading Mastery

Bitcoin trading mastery doesn’t happen overnight—it’s a skill developed through education, practice, and disciplined execution. The cryptocurrency market operates 24 hours a day, seven days a week, creating endless opportunities for traders who understand how to analyze market conditions and execute profitable strategies.

Day trading involves buying and selling Bitcoin within a single day, aiming to profit from small price fluctuations, requiring quick decision-making and access to real-time data to identify ideal entry and exit points. This intense trading style demands focus but offers the potential for substantial daily profits when executed correctly.

The foundation of trading mastery lies in understanding market structure, recognizing patterns that repeat throughout Bitcoin’s price history, and developing the mental fortitude to stick with your trading plan during both winning and losing periods. Professional traders spend years honing these skills, but you can accelerate your learning curve by following proven frameworks and strategies.

The Mindset Required for Trading Success

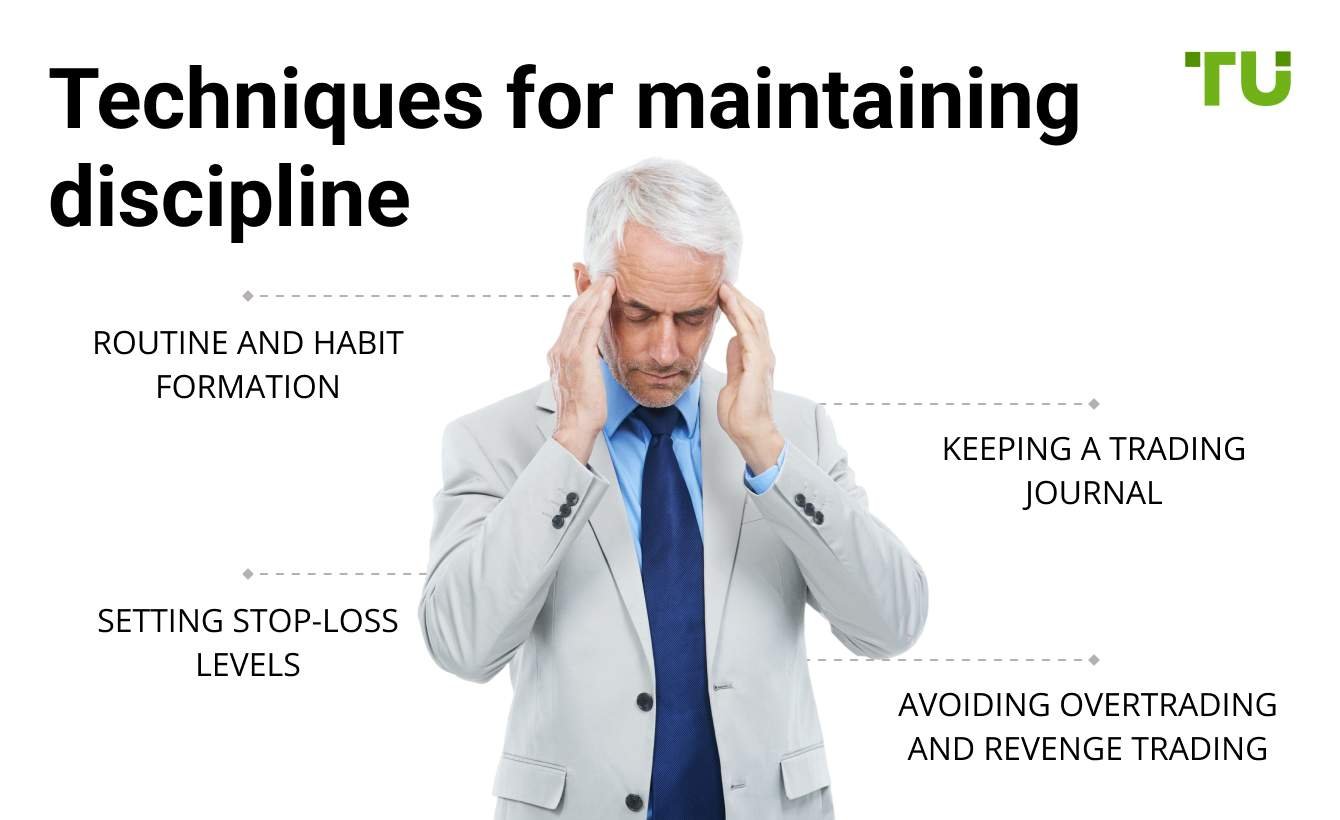

Research shows that 70-80% of traders experience heightened emotions during market volatility, often leading 40% of retail traders to exit trades prematurely due to fear. Developing emotional control separates profitable traders from those who consistently lose money.

Successful traders approach Bitcoin trading as a business, not gambling. They maintain detailed records, analyze their performance objectively, and continuously refine their strategies based on market feedback. This professional mindset helps you make rational decisions even when emotions run high during volatile market conditions.

Essential Bitcoin Trading Strategies for Mastery

Multiple proven strategies exist for Bitcoin trading, each suited to different timeframes, risk tolerances, and trading styles. Understanding and mastering several approaches gives you the flexibility to adapt as market conditions change.

Day Trading Strategy for Active Traders

BTC/USDT, ETH/USDT, and SOL/USDT are ideal for day trading due to high liquidity, narrow spreads, and strong technical chart patterns. Day trading requires constant market monitoring and quick execution, but can generate impressive returns when market volatility increases.

Successful day traders typically focus on liquid trading pairs and use technical indicators like moving averages, RSI, and volume analysis to identify short-term opportunities. The goal is to capture small price movements multiple times throughout the day, accumulating profits that compound significantly over time.

Swing Trading for a Balanced Approach

Swing trading focuses on capturing price movements over several days or weeks, making it suitable for those who prefer a more flexible approach without constant monitoring. This strategy allows traders to maintain their regular jobs while still actively managing Bitcoin positions.

Swing traders identify intermediate-term trends and position themselves to profit from larger price movements. By holding positions for days or weeks, swing traders can capture substantial portions of major trends while requiring less screen time than day trading.

Scalping for Quick Profits

Scalping is a good technique for traders who are not afraid of risky Bitcoin trading strategies and want to have a favorable return on the slightest price fluctuations, best suited for trading high-volatility cryptocurrencies on the smallest timeframe charts. Scalpers make dozens or even hundreds of trades daily, profiting from tiny price movements.

This intense strategy requires low transaction fees, fast execution speeds, anda deep understanding of technical analysis. While individual profits per trade are small, the volume of successful trades can generate substantial overall returns.

Long-Term HODLing Strategy

HODLing is a popular strategy for long-term investors who buy Bitcoin and hold it for years, aiming to benefit from the asset’s overall upward trajectory despite short-term volatility. This approach requires strong conviction and psychological fortitude during market downturns.

Bitcoin experienced multiple corrections exceeding 50% since 2011, testing holders’ conviction, yet patient investors eventually recovered and profited. Long-term holders focus on Bitcoin’s fundamental value proposition and adoption trajectory rather than short-term price movements.

Mastering Technical Analysis for Bitcoin Trading

Technical analysis forms the cornerstone of most winning Bitcoin trading strategies. Understanding how to read charts, identify patterns, and interpret indicators gives you a significant edge in predicting future price movements.

Critical Chart Patterns

The head-and-shoulders pattern is one of the most reliable bearish reversal signals, with an 80% success rate when fully confirmed, consisting of three peaks with the central high point between two lower peaks connected by a neckline. Recognizing these patterns early allows you to position yourself before major trend changes occur.

Other important patterns include ascending and descending triangles, flags, pennants, and double tops and bottoms. Each pattern provides specific entry and exit signals that, when combined with proper risk management, create high-probability trading setups.

Essential Technical Indicators

Professional Bitcoin traders rely on several key indicators to confirm their trading decisions. Moving averages help identify trend direction, with the 20, 50, and 200-period moving averages serving as critical support and resistance levels.

The Relative Strength Index (RSI) measures momentum and identifies overbought and oversold conditions. When RSI readings exceed 70, Bitcoin may be overbought, while readings below 30 suggest oversold conditions. However, during strong trends, these levels can persist longer than expected.

MACD (Moving Average Convergence Divergence) provides trend and momentum insights simultaneously. MACD crossovers and divergences often signal potential trend changes before they become obvious in price action alone.

Volume Analysis and Confirmation

Volume serves as a crucial confirmation tool for price movements. High volume during price advances confirms strong buying interest, while high volume during declines indicates serious selling pressure. Trading decisions made with volume confirmation have significantly higher success rates than those based solely on price action.

Risk Management: The Foundation of Bitcoin Trading Mastery

Professional traders prioritize capital preservation over profit maximization, understanding that survival in the market ultimately leads to long-term profitability.

The 1% Risk Rule

Professional traders calculate position size based on stop-loss distance—with $100,000 capital, accepting $1,000 risk per trade (1%), buying Bitcoin at $42,000 with a stop at $40,000 means purchasing 0.5 Bitcoin. This systematic approach ensures no single trade can significantly damage your account.

Risking no more than 1-2% of your account per trade, with daily limits capping losses or trades per day (such as stopping trading after a 5% portfolio loss), prevents catastrophic losses and allows you to trade another day even after experiencing a losing streak.

Position Sizing Strategies

Position sizing formula: with $10,000 risking 1% on a Bitcoin trade with entry at $60,000 and stop-loss at $57,000, your calculation would be Position Size = ($10,000 × 0.01) ÷ ($60,000 – $57,000) = 0.033 BTC.

Proper position sizing ensures your risk remains constant across all trades, regardless of stop-loss distance. This consistency is crucial for achieving predictable long-term results and maintaining psychological stability during trading.

Stop-Loss and Take-Profit Orders

Stop-loss orders automatically exit losing positions before they cause significant damage to your account. Setting stop-losses below the neckline or trendline protects your capital from sharp reversals, while keeping position sizes small ensures one mistake does not wipe out weeks of progress.

Take-profit orders lock in gains by automatically closing positions when the price reaches your target. This removes the temptation to hold positions too long, hoping for additional profits, which often results in giving back your gains when trends reverse.

Advanced Strategies for Experienced Traders

Once you’ve mastered basic strategies and risk management, advanced techniques can further improve your trading results and adapt to different market conditions.

Arbitrage Trading Opportunities

Crypto arbitrage exploits price discrepancies between different exchanges or trading pairs, generating relatively low-risk profits through simultaneous buying and selling—for instance, Bitcoin might trade at $42,000 on Coinbase while simultaneously priced at on Kraken.

Professional arbitrageurs overcome execution challenges through pre-funded accounts on multiple exchanges and automated bots that monitor price differentials, executing trades when spreads exceed transaction costs plus a profit margin.

Dollar-Cost Averaging for Consistent Accumulation

Dollar cost averaging involves investing fixed amounts at regular intervals regardless of price, mechanically buying more units when prices fall and fewer when prices rise, removing emotional decision-making and timing risks. This systematic approach works particularly well for building long-term Bitcoin positions.

While DCA may underperform lump sum investing during strong uptrends, it significantly reduces the psychological stress of trying to time market entries and ensures consistent accumulation regardless of short-term volatility.

Leveraged Trading for Amplified Returns

Starting with a low leverage of 3x-5x helps survive volatility, with position sizing calculated based on stop-loss distance to limit risk, and diversifying to avoid putting all capital into one trade or coin.

Many traders apply 10x or 20x leverage without understanding how quickly losses compound—using high leverage without proper sizing turns minor price fluctuations into full account liquidations. Conservative leverage use combined with strict risk management allows experienced traders to maximize returns while maintaining account safety.

Building Your Bitcoin Trading System

Creating a systematic approach to Bitcoin trading removes guesswork and emotion from your decision-making process. A well-designed trading system defines your edge, entry criteria, exit rules, and risk parameters.

Developing Your Trading Plan

Your trading plan should specify which strategies you’ll employ, the timeframes you’ll analyze, and the exact conditions that must be met before entering trades. Professional traders document their plans in writing and review them regularly to ensure consistency.

Include specific rules for entry signals, stop-loss placement, take-profit targets, and position sizing. The more detailed your plan, the easier it becomes to execute trades objectively without second-guessing your decisions.

Backtesting and Forward Testing

Before risking real capital, test your strategies using historical data to verify they would have been profitable in the past. Backtesting reveals the expected win rate, average profit per trade, and maximum drawdown of your system.

Forward testing with paper trading or small positions allows you to verify your strategy works in current market conditions before scaling up to larger position sizes. This graduated approach builds confidence and identifies any flaws in your system before they cause significant losses.

Performance Tracking and Analysis

Detailed record-keeping helps identify which strategies work best in different market conditions and reveals patterns in your decision-making.

Review your trading journal regularly to identify mistakes, improve execution, and capitalize on your strengths. Successful traders treat their trading history as a learning resource that continuously improves their performance over time.

Common Mistakes That Prevent Bitcoin Trading Mastery

Learning what not to do is as important as learning winning strategies. Avoiding common pitfalls accelerates your journey toward consistent profitability.

Emotional Trading Pitfalls

Fear leads to irrational decisions like exiting trades prematurely or avoiding the market altogether—for instance, when Bitcoin dipped to $58,000, triggering panic selling, the price rebounded to $63,000 within days, leaving fearful traders at a loss. Emotional decisions typically result in buying high and selling low, the opposite of profitable trading.

Greed causes traders to take oversized positions or hold winning trades too llongg hoping for additional profits. Both emotions destroy trading accounts faster than poor technical analysis or bad timing.

Overtrading and Its Consequences

Quality setups are limited, and attempting to trade constantly leads to taking marginal setups with poor risk-reward ratios.

Successful traders wait patiently for high-probability setups that meet their criteria rather than forcing trades to stay busy. This selective approach dramatically improves overall profitability by focusing capital on the best opportunities.

Ignoring Risk Management

Common mistakes include FOMO buying, overleveraging, ignoring stop-losses, and trading without a plan—lack of research and entering trades based on rumors instead of research increases risk. Any of these mistakes can destroy an otherwise profitable trading strategy.

Professional traders follow their risk rules religiously, even when tempted to deviate. This discipline protectitsir capital during challenging periods and ensures long-term survival in the markets.

Practical Tips for Achieving Bitcoin Trading Mastery

Implementing these practical recommendations accelerates your progress toward consistent profitability and trading expertise.

Continuous Education and Adaptation

Markets evolve constantly, requiring traders to continuously update their knowledge and adapt their strategies. Follow reputable trading educators, study successful traders’ approaches, and stay informed about market developments affecting Bitcoin.

Join trading communities where you can discuss strategies, share insights, and learn from others’ experiences. However, always verify information independently and avoid blindly following others’ trading signals.

Starting Small and Scaling Gradually

While you can start trading Bitcoin with as little as $100, having $500-$1,000 gives more flexibility for diversification, risk management, and taking advantage of both spot and futures strategies. Begin with smaller positions to gain experience without risking significant capital.

As you demonstrate consistent profitability and gain confidence in your strategies, gradually increase position sizes while maintaining the same risk percentage. This conservative approach protects you during the learning phase while allowing account growth as your skills improve.

Using Technology and Tools Effectively

Modern trading platforms offer sophisticated tools for analysis, execution, and risk management. Use trading bots for automation, especially for scalping and arbitrage, while manual strategies work well for swing or trend trading—many traders combine both methods.

Leverage available technology to improve execution speed, monitor multiple markets simultaneously, and automate routine tasks. However, maintain ultimate control over your trading decisions rather than relying completely on automated systems.

Conclusion: Your Path to Bitcoin Trading Mastery Starts Now

Achieving Bitcoin Trading Mastery: Learn Winning Strategies Now requires combining technical knowledge, risk management discipline, and psychological control into a comprehensive trading system. The strategies outlined in this guide provide a proven roadmap for developing profitable trading skills that generate consistent returns in the dynamic cryptocurrency market.

Remember that trading mastery is a journey, not a destination. Every successful trader started exactly where you are now—as a beginner with dreams of financial freedom and concerns about making mistakes.

The cryptocurrency market offers unprecedented opportunities for traders who dedicate themselves to mastering their craft. With Bitcoin’s institutional adoption increasing and market infrastructure maturing, conditions have never been better for serious traders to build sustainable trading businesses.