Bitcoin trading explained: from basics to advanced strategies is your essential roadmap to mastering cryptocurrency markets in 2026. Whether you’re taking your first steps into digital currency trading or seeking to elevate your existing skills, understanding how Bitcoin trading works can unlock tremendous financial opportunities. The cryptocurrency market operates around the clock, offering unique advantages that traditional markets simply can’t match. This comprehensive guide walks you through everything from fundamental concepts to professional trading techniques that can help you navigate this exciting but volatile landscape. You’ll discover practical strategies, critical risk management principles, and actionable tips that separate successful traders from those who struggle.

Understanding Bitcoin Trading: The Fundamentals

Bitcoin trading involves buying and selling the world’s leading cryptocurrency to capitalize on price movements. Unlike traditional investing, where you buy and hold for years, trading focuses on shorter timeframes to generate consistent profits from market fluctuations.

The beauty of Bitcoin trading lies in its accessibility. Markets operate 24/7, meaning you can trade anytime from anywhere in the world. This continuous activity creates constant opportunities but also requires discipline and strategic planning.

When you trade Bitcoin, you’re essentially speculating on whether its price will rise or fall. Traders use various analysis methods, tools, and strategies to make informed decisions about when to enter and exit positions.

Why Trade Bitcoin?

Several compelling reasons attract traders to Bitcoin:

High Volatility: Bitcoin experiences significant price swings, creating opportunities for substantial profits in short periods. While volatility increases risk, it also amplifies potential rewards for skilled traders.

24/7 Market Access: Unlike stock markets that close on weekends, Bitcoin trades continuously. You can respond to breaking news and market events at any hour.

Lower Barriers to Entry: You can start trading with relatively small amounts. Many exchanges allow purchases as low as $10, though realistic trading requires more capital.

Growing Adoption: Institutional investors, major corporations, and governments increasingly embrace Bitcoin, driving long-term value appreciation alongside short-term trading opportunities.

Liquidity: Bitcoin is the most liquid cryptocurrency, meaning you can buy and sell large amounts without significantly impacting price.

How Bitcoin Trading Works

Cryptocurrency Exchanges Explained

Bitcoin trading primarily happens on cryptocurrency exchanges—digital platforms that connect buyers and sellers globally. These exchanges function like traditional stock markets but operate exclusively for digital assets.

Popular exchanges include Coinbase, Binance, Kraken, Gemini, and Bitstamp. Each platform offers different features, fee structures, security measures, and user experiences. Your choice of exchange significantly impacts your trading success.

When selecting an exchange, consider these factors:

- Security Features: Look for platforms with cold storage, two-factor authentication, insurance policies, and strong track records

- Trading Fees: Compare maker/taker fees, withdrawal costs, and deposit charges

- User Interface: Choose platforms that match your experience level

- Available Features: Consider charting tools, order types, and advanced trading options

- Liquidity: Higher liquidity means better prices and easier execution

- Regulatory Compliance: Select licensed exchanges for legal protection

Types of Trading Orders

Understanding order types helps you execute trades precisely:

Use these when speed matters more than getting an exact price. Market orders guarantee execution but not price.

Limit Orders let you specify the exact price for buying or selling. Your order sits in the order book until the market reaches your price. This gives you price control but no guarantee of execution.

Stop-Loss Orders automatically sell your Bitcoin when it reaches a predetermined price, protecting you from excessive losses. Every professional trader uses stop-losses to manage risk effectively.

Take-Profit Orders automatically close positions when your profit target is reached, helping you lock in gains without constant monitoring.

Bitcoin Trading Strategies for Beginners

Starting with Spot Trading

Spot trading represents the most straightforward entry point for beginners. You purchase actual Bitcoin at current market prices and take ownership of the cryptocurrency. Your profit comes from selling at higher prices than your purchase price.

This approach is perfect for newcomers because it’s intuitive and doesn’t involve complex financial instruments. You can transfer your Bitcoin to personal wallets, maintaining complete control over your assets.

Setting Up Your First Trade

Before placing your first trade, take these essential steps:

Step 1: Choose a Reputable Exchange Research thoroughly, comparing security features, fees, and user reviews. Create an account and complete the verification process, which typically requires identity documentation.

Step 2: Fund Your Account. Deposit money using bank transfers, credit cards, debit cards, or other accepted payment methods. Start with an amount you’re comfortable losing while learning.

Step 3: Learn the Platform. Familiarize yourself with the interface before risking real money. Most exchanges offer demo accounts or test environments for practice.

Step 4: Execute Your First Trade. Start small. Buy a modest amount of Bitcoin using a limit order to control your entry price. Don’t invest everything at once—scale in gradually as you gain confidence.

Reading Bitcoin Price Charts

Price charts are essential tools for informed trading decisions. Most traders prefer candlestick charts, which display four critical price points per time period:

- Open: Price at the period’s start

- Close: Price at the period’s end

- High: Highest price during the period

- Low: Lowest price during the period

Green (or white) candles indicate bullish periods where closing prices exceeded opening prices. Red (or black) candles show bearish periods where prices declined.

Learning to read these patterns helps you identify trends, support levels, resistance zones, and potential reversal points.

Essential Trading Vocabulary

Master these fundamental terms:

Bull Market: Extended upward price trend driven by optimism and buying pressure

Bear Market: Extended downward trend characterized by pessimism and selling pressure

Support: Price level where buying interest prevents further declines

Resistance: Price level where selling pressure stops further advances

Volume: Total Bitcoin traded during a specific period, indicating market participation

Volatility: Degree of price fluctuation, measuring risk and opportunity

Liquidity: How easily Bitcoin can be bought or sold without affecting the price

For comprehensive cryptocurrency education and market insights, visit CoinMarketCap Learn for beginner-friendly tutorials.

Bitcoin Trading Explained: From Basics to Advanced Strategies

Strategy 1: HODLing (Long-Term Holding)

“HODL” originated from a misspelled forum post and now represents holding Bitcoin through market volatility, believing in long-term appreciation. This strategy requires minimal active management.

Advantages:

- Minimal time investment

- No need for constant market monitoring

- Historically successful for Bitcoin

- Lower tax implications in many jurisdictions

- Less stressful than active trading

Best Practices:

- Buy during market dips for better entry prices

- Use dollar-cost averaging to spread purchases over time

- Store Bitcoin in secure hardware wallets

- Ignore short-term price fluctuations

- Set a long-term target (3-5 years minimum)

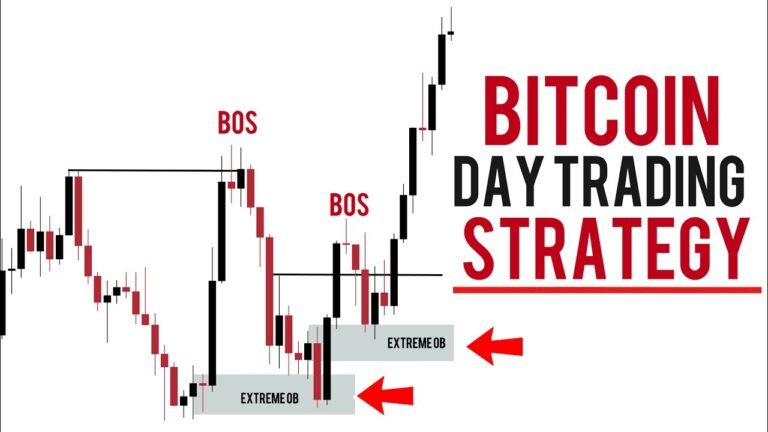

Strategy 2: Day Trading Bitcoin

Day traders open and close all positions within a single trading day, never holding overnight. This intensive strategy capitalizes on intraday price movements.

Requirements for Success:

- Strong technical analysis skills

- Quick decision-making abilities

- Sufficient capital to absorb fees

- Time to monitor markets actively

- Emotional discipline and strict risk management

Day Trading Best Practices:

- Trade during high-volume periods (typically when U.S. and European markets overlap)

- Focus on liquid trading pairs for better execution

- Keep detailed trading journals, tracking every decision

- Take regular breaks to maintain mental sharpness

Strategy 3: Swing Trading

Swing traders hold positions for days to weeks, profiting from expected price swings. This approach balances active trading with reasonable time commitments.

Swing Trading Framework:

- Identify trends using daily or 4-hour charts

- Enter at support levels during uptrends

- Set profit targets at previous resistance levels

- Use trailing stops to protect gains

- Monitor positions once or twice daily

Strategy 4: Scalping

Scalpers execute numerous trades daily, targeting small price movements. This high-frequency approach demands exceptional timing and minimal trading fees.

Scalping Essentials:

- Ultra-fast execution platforms

- Extremely low trading costs (maker rebates ideal)

- Deep understanding of order book dynamics

- Ability to make split-second decisions

- High risk tolerance and stress management

Strategy 5: Trend Following

Trend followers ride dominant market directions. The principle is simple: trends persist until they don’t, so trade with the trend until clear reversal signals appear.

Trend Trading Tools:

- Moving averages to identify direction

- Trendlines connecting price points

- ADX indicator to measure trend strength

- Volume analysis to confirm momentum

- Breakout patterns signaling continuation

Advanced Technical Analysis

Moving Averages for Trend Identification

Moving averages smooth price data, revealing underlying trends.

Golden Cross: When the 50-day moving average crosses above the 200-day, it signals strong bullish momentum. This pattern often precedes significant upward moves.

Death Cross: When the 50-day crosses below the 200-day, it indicates bearish momentum. Traders often use this signal to exit positions or establish shorts.

Relative Strength Index (RSI)

. Values above 70 suggest overbought conditions where prices may reverse downward.</span> Values below 30 indicate oversold conditions where prices may bounce upward.

Smart traders look for divergences—when price makes new highs, but RSI doesn’t, or vice versa. These divergences often signal impending reversals.

Bollinger Bands

Bollinger Bands plot standard deviations around a moving average, visualizing volatility. When bands narrow, it indicates low volatility and potential breakouts. When bands widen, volatility is high.

However, during strong trends, prices can ride bands for extended periods.

Volume Analysis

Volume confirms price movements. Rising prices on increasing volume indicate strong conviction and sustainable moves. Price advances on declining volume suggest weakness and potential reversals.

Always analyze volume alongside price action. Volume precedes price—significant volume changes often signal upcoming price movements.

Risk Management: Protecting Your Capital

Position Sizing Fundamentals

Never risk too much on single trades. Professional traders typically risk only 1-2% of total capital per trade. This ensures that even consecutive losses won’t devastate your account.

Position Sizing Formula: Risk per trade = (Account Size × Risk Percentage) ÷ (Entry Price – Stop-Loss Price)

For example, with a $10,000 account risking 2% per trade, you risk $200. If your entry is $50,000 and the stop-loss is $48,000, your position size is 0.1 Bitcoin.

Stop-Loss Strategies

Stop losses protect capital by automatically exiting losing positions:

Fixed Percentage Stops: Exit when price moves against you by a set percentage (typically 2-5%)

Support/Resistance Stops: Place stops just beyond key support (for longs) or resistance (for shorts)

ATR-Based Stops: Use Average True Range to set stops based on current volatility

Trailing Stops: Move stops upward as price rises, protecting profits while giving trades room to develop

Risk-Reward Ratios

Only take trades offering favorable risk-reward ratios. Aim for a minimum 2:1 or 3:1 ratio, meaning if you risk $100, your profit target should be $200-$300.

This ensures profitability even with modest win rates. With a 3:1 ratio, you can be profitable, winning only 40% of trades.

Common Trading Mistakes to Avoid

Emotional Decision-Making

Fear and greed destroy trading accounts. Fear causes premature exits from winning positions. Greed leads to overleveraging or holding losers, hoping for recoveries.

Solution: Create detailed trading plans before entering positions. Follow your plan regardless of emotions. Use predetermined entry points, exit targets, and stop-losses.

Overleveraging Positions

Excessive leverage amplifies both gains and losses. Many beginners blow up accounts using 10x, 50x, or 100x leverage without understanding the risks.

Solution: Start with zero leverage. As you gain experience, use modest leverage (maximum 2x-5x). Remember, leverage doesn’t improve your win rate—it only magnifies outcomes.

Chasing FOMO

Fear of missing out causes traders to buy after massive price increases, often near local tops. This emotional response typically leads to painful losses.

Solution: Wait for pullbacks to support levels. Use limit orders defining acceptable entry prices. If you miss a move, wait patiently for the next opportunity.

Neglecting Security

Cryptocurrency theft is permanent. Leaving large amounts on exchanges or using weak passwords can result in total loss.

Solution: Store long-term holdings in hardware wallets (Ledger, Trezor). Enable two-factor authentication everywhere. Use unique, complex passwords. Never share private keys.

Ignoring Tax Obligations

Every trade creates taxable events in most jurisdictions. Failing to report accurately results in penalties, interest, and potential legal problems.

Solution: Use cryptocurrency tax software tracking all transactions. Consult tax professionals familiar with crypto regulations in your jurisdiction. Keep detailed records.

Essential Trading Tools and Resources

Trading Platforms

TradingView: Industry-standard charting platform with advanced technical analysis tools, custom indicators, and social trading features. The free version offers excellent functionality.

Coinigy: Connects multiple exchanges in one interface, enabling unified portfolio management and cross-exchange trading.

3Commas: Provides trading bots, smart trading terminals, and portfolio management tools for strategy automation.

Portfolio Tracking

CoinStats: Monitors holdings across exchanges and wallets with real-time valuations, profit/loss tracking, and price alerts.

Delta: Features comprehensive portfolio tracking, news aggregation, and customizable watchlists for opportunity monitoring.

Market Data and Analysis

Glassnode: Offers on-chain analytics, network metrics, and advanced data visualization for fundamental Bitcoin analysis.

CryptoQuant: Provides exchange flow data, miner metrics, and institutional activity indicators for informed decision-making.

Stay informed through reputable sources like CoinDesk, The Block, and Bitcoin Magazine. [Internal link: “Complete Cryptocurrency Trading Course for 2026”]

Conclusion: Your Path to Trading Success

Bitcoin Trading Explained: From Basics to Advanced Strategies provides a comprehensive framework for navigating cryptocurrency markets successfully. This journey demands dedication, continuous learning, emotional discipline, and unwavering commitment to risk management principles.

The Bitcoin trading landscape offers extraordinary opportunities for those willing to invest time and effort. Markets continue evolving with institutional adoption, regulatory clarity, and technological innovation, creating new possibilities for informed traders.

Ready to start your Bitcoin trading journey? Take action today. Open an account on a reputable exchange, start with small positions, practice the strategies outlined in this guide, and commit to ongoing education. . and learningh to master Bitcoin trading explained: from basics to advanced strategies begins right now. Download a charting platform, study price patterns, and execute your first paper trades. The future of finance is here, and you have everything needed to participate successfully. Start today, stay disciplined, and watch your skills grow.